Usda Home Loans Indiana Map

Usda Home Loans Indiana Map – No money is required down and additional costs are low and affordable. Water and Environmental Direct. As of October.

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

26042019 You will find that most of Indiana is eligible for USDA financing.

Usda Home Loans Indiana Map. Since its inception in 1949 the USDA. It is one of the most cost-effective home buying programs in the marketplace today. This mortgage type reduces costs for homebuyers in eligible rural and suburban areas.

Providing these affordable homeownership opportunities promotes prosperity which in turn creates thriving communities and improves the. USDA Home Loan Indiana. The loan program falls under their single-family housing.

In order to be eligible for many USDA loans household income must meet certain guidelines. USDA Home Loan Indiana. 08012019 The USDA eligibility map is used to check property eligibility which is one of the two main USDA loan qualification requirements.

24052017 The easiest way to find USDA loan areas on your own is with the USDA maps. Water and Environmental Guaranteed. To learn more about USDA home loan programs and how to apply for a USDA loan click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected.

All mortgage loans regardless of program require mortgage insurance if the down payment is less than 20. Rural Development will keep our customers partners and stakeholders continuously updated as more actions are taken to better serve rural. USDA uses buyer-paid mortgage insurance premiums to continually fund the program.

The USDA provides an interactive map where you can either type in a specific address or view an eligibility map for a general area. When you decide to buy a home or refinance a mortgage in Indiana your prime concern is to find a home loan in Indiana thats best suited to your needs. USDA mortgage insurance is separated into an upfront fee and an annual fee.

The USDA loan is the least common of the main four types of home loans FHA VA Conventional and USDA its popularity has grown significantly over the last several years due to the many attractive features that it has. Usda Home Loan Map Maryland. Usda Home Loan Map Fl.

Single Family Housing Guaranteed. Usda Home Loan Map Tn. USDA Rural Developments Section 502 Direct Loan Program provides a path to homeownership for low- and very-low-income families living in rural areas and families who truly have no other way to make affordable homeownership a reality.

Usda Home Loan Map Nc. Fortunately a very high percentage of the United States is USDA eligible. Single Family Housing Direct.

07022020 The United States Department of Agriculture USDA sets lending guidelines for the program which is why it is also called the USDA Rural Development RD Loan. First you must accept the disclaimer. Just a reminder USDA financing is not only for the purchase of farmland or homes on farms.

USDA Rural Development has taken a number of immediate actions to help rural residents businesses and communities affected by the COVID-19 outbreak. October 17 2018 by Jerry. Next decide if you want to.

17102018 Usda Home Loan Map Indiana. Usda Home Loans Indiana Map. Very often whole counties are USDA eligible.

All of a sudden houses pop up and you can pretty easily see which ones qualify. Usda Home Loan Eligibility Map Washington. Moderate income is 80.

The USDA guaranteed loan is where borrowers obtain a home loan from a private lender or bank and the loan is backed or guaranteed by the USDA. Federal government websites always use a gov or mil domain. Or worse you may find yourself not eligible for most of them.

The United States Department of Agriculture supports the USDA Rural Development loan also known as the Single Family Housing Guaranteed loan. Usda Home Loan Map Ohio. Since the USDA loan is a zero-down mortgage all loans are subject to mortgage insurance fees.

Therefore to access USDA loan benefits including no down payment property eligibility is mandatory. Community Facilities Guaranteed Property Eligibility Disclaimer. I am Looking For NEWS.

First choose Single Family Housing Guaranteed This is the most common USDA program. But with so many loans to choose from you may end up making a wrong choice. USDA Rural Development COVID-19 Response.

It is the only non-veteran loan that has this feature. The United States Department of Agriculture created the rural development loan also known as the USDA guaranteed loan or USDA rural housing loan to help promote home ownership for lower and middle income households. USDA Direct Rural Housing Mortgage USDA Direct Housing Loans are less common than USDA Guaranteed Loans and are only available for low and very low income households to obtain home ownership as defined by the USDA.

Buying in or around large. The loan is designed for low to moderate-income families in Indiana and across the US. Also the home to be purchased must be located in an eligible rural area as defined by USDA.

Very low income is defined as below 50 percent of the area median income AMI. So once you know for instance that one side of Ten-Ten qualifies for this program its pretty easy to go to Zillow and put in Garner NC. Business and Industry Guaranteed Loans BI Guar Rural Business Enterprise Grants RBEG Rural Business Opportunity Grants RBOG Rural Energy for America Program REAP Rural Microentrepreneur Assistance Program RMAP Biorefinery Assistance Program BAP Intermediary Relending Program IRP Click Here for the following programs.

OneRD Loan Guaranteed. The loan program offers a 100 no money down feature. Usda Home Loan Map Oregon.

This mortgage loan is designed to assist low- and moderate-income households with purchasing decent safe and sanitary homes in approved rural areas. Once you accept the site brings up a map of the United States. The gov means its official.

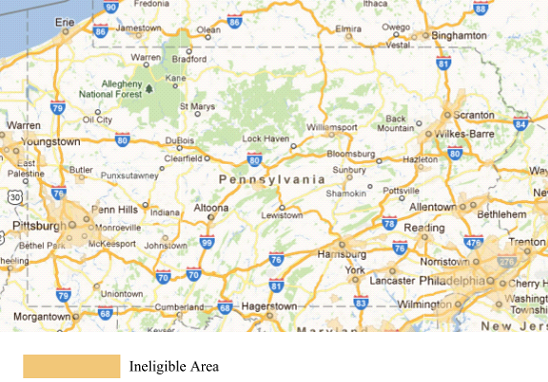

Every effort is made to provide. 05032010 Look at the Maps Below the properties shaded in Orange do NOT qualify for USDA Home Loan Financing however all of those OTHER areas do. An Indiana USDA loan is a home loan that is backed by the United States Department of Agriculture.

While these mortgages are known for assisting low income families to buy a home in a rural area USDA loans are actually available to moderate income. Before sharing sensitive information online make sure youre on a gov or mil site by inspecting your browsers address or location bar. 21 Posts Related to Usda Home Loan Map Indiana.

Low income is between 50 and 80 percent of AMI. The USDA Single Family Direct program is for very low-income families.

Pennsylvania Usda Loan Information Application Usdaloans Net

Pennsylvania Usda Loan Information Application Usdaloans Net

Usda Loan Map Property Eligibility Usdasearch Com

Lawrence County Usda Rural Development Mortgage Loan

Usda Home Loan Map Alabama Vincegray2014

Hendricks County Usda Loan Map

Usda Eligible Approved Housing Map Changes Usda Source

Tampa Usda Loan 100 Financing Usda Mortgage Source

Usda Rural Development Home Loans Map Page 1 Line 17qq Com

Oregon Usda Loan Eligibility Information Application Usdaloans Net

Community Facilities Guaranteed Loan Program In Oregon Rural Development

Usda Eligibility Map Is Key Before Looking For A No Money Down Home

Lane County Oregon Usda Loan Map Usa Home Financing

First Time Home Buyer Usda Home Loan Zero Down Mortgage

Property Eligibility Usda Rural Development Loan

Property Eligibility Usda Rural Development Loan

Usda Eligibility Map Texas Usda Home Loans Maryland Avie Home Vincegray2014

State Maps Of Usda Plant Hardiness Zones

Is The Home I M Interested In Located In Usda Mortgage Territory Indiana Usda Mortgages

18 Winchester Kentucky Usda Rural Housing Map For Mortgage Loans Eligibility Ideas Mortgage Loans Kentucky Mortgage

Indiana County Usda Rural Development Mortgage Loan

Usda Home Loans Zero Down Eligibility Qualify In 2021

Missouri Usda Loan Eligibility Information Application

Usda Home Loans Indiana Map Vincegray2014

Is The Home I M Interested In Located In Usda Mortgage Territory Indiana Usda Mortgages

Usda Home Loans Indiana Map Vincegray2014

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements